The recent announcement of Trump tariffs on the EU and Mexico has reignited concerns about trade relations between the United States and its major partners. President Donald Trump is set to impose a staggering 30% tariff on all goods exported from these nations, potentially escalating the ongoing Trump trade war. This drastic tariff increase could impact Mexico U.S. trade relations significantly, affecting everything from agricultural imports to consumer goods. With analysts predicting that the impact of tariffs on inflation could spark higher prices for everyday items, many are bracing for the repercussions. As Trump’s tax on imports looms, the global market watches closely to see how Europe and Mexico will respond.

Amid swirling tensions regarding international commerce, recent developments signal a major shift in U.S. trade policy towards key allies, namely Europe and Mexico. The administration’s decision to levy steep tariffs could not only strain diplomatic ties but also disrupt the flow of essential goods across borders. Such initiatives may reshape the landscape of bilateral trade agreements and contribute to a more competitive global market. The ramifications will likely extend beyond monetary policy, influencing inflation and trade dynamics on both sides of the Atlantic. As negotiations continue, stakeholders remain wary of the impending effects on import duties and economic stability.

Overview of Trump Tariffs on EU and Mexico

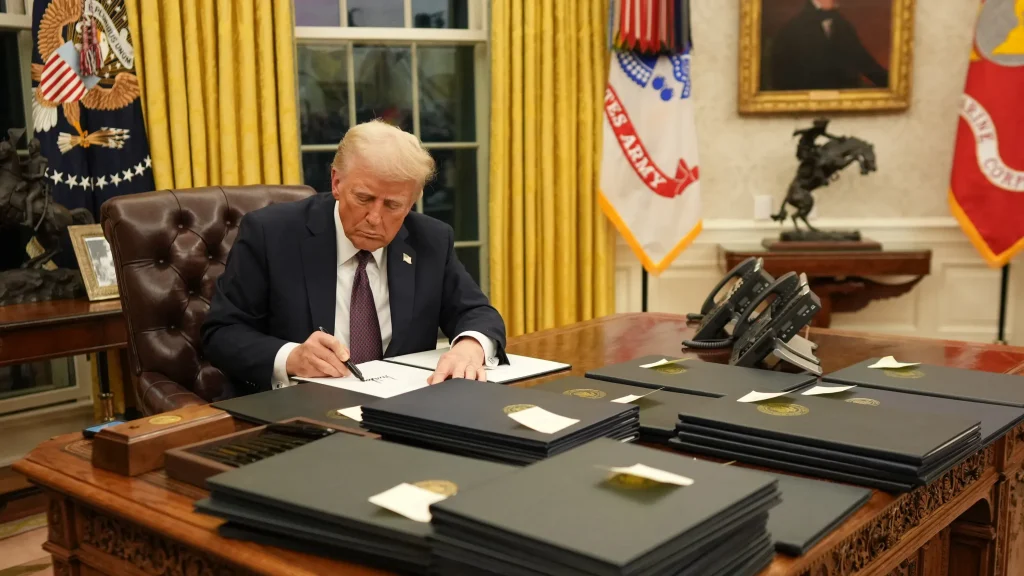

In a bold move that has captured global attention, President Donald Trump has proposed significant tariffs on imports from the European Union and Mexico. Effective August 1, 2024, a 30% tariff will be imposed on all goods exported to the United States from these two major trading partners unless counteractions are taken. This decision marks a new phase in Trump’s trade strategy, which appears to intensify the existing trade tensions that have characterized his presidency. By targeting the E.U. and Mexico, Trump aims to address concerns over trade imbalances but risks unleashing a series of retaliatory responses that could escalate the trade war further.

Trump’s tariffs are not merely punitive; they represent an effort to stimulate U.S. manufacturing by raising the cost of foreign goods. However, the implications of such a tariff increase are complex, particularly when considering the interconnectedness of the global supply chain. Analysts and economists warn that this strategy may backfire, leading to higher prices for American consumers and businesses. The looming question is whether the Trump administration will find leverage in these tactics or if they will trigger countermeasures that could exacerbate economic volatility.

Impact of Tariff Increases on U.S. Economy

The proposed tariff increases on European and Mexican imports could have far-reaching effects on the U.S. economy. Already navigating through a delicate inflation landscape, the introduction of a blanket 30% tariff may exacerbate existing inflationary pressures. With essential imports from Mexico and the E.U.—including fresh produce, pharmaceuticals, and industrial goods—subject to higher costs, consumers can expect increased prices. This scenario is underscored by expert analyses indicating that disruptions in trade could indeed lengthen the timeline of inflationary impacts across various sectors.

Furthermore, the potential rise in tariffs raises concerns regarding the overall U.S. economic growth trajectory. With economic stability dependent on various factors, including consumer spending and business investment, any disruption caused by trade tensions can hinder economic progress. The alarming prospect of extended inflation combined with stagnant wage growth could lead to a challenging economic environment for many American families, adding a layer of complexity to the administration’s approach to trade policy.

Trump’s Trade War with Mexico: Implications and Consequences

Trump’s tariffs on Mexico exemplify the ongoing struggles within U.S.-Mexico trade relations. With substantial agricultural imports from Mexico accounting for nearly 69% of U.S. vegetable supplies, any increase in tariffs could lead to swift price hikes. Fresh produce, often subject to rapid turnover and lower shelf life, may see immediate inflationary effects. This situation poses challenges not only for consumers but also for U.S. farmers who rely heavily on the import of raw materials from their southern neighbor to sustain their operations.

Moreover, Trump’s focus on border security and combating drug trafficking has fueled tensions with Mexico, complicating trade discussions further. The Mexican government has expressed its commitment to cooperation, yet the pressure from escalating tariffs could strain diplomatic relations, potentially prompting retaliatory measures from Mexico. The outcome of this trade war could redefine not only U.S.-Mexico relations but also the agricultural and manufacturing landscapes within both nations.

Types of Goods Affected by Trump Tariffs

The impending tariff surge affects a diverse range of goods, with pharmaceuticals, automobiles, and machinery topping the list of exports from the European Union and Mexico to the United States. Drugs and medical supplies have been particularly highlighted, as Trump has even hinted at imposing a staggering 200% tariff on these essential imports. Such measures could disrupt the availability of critical healthcare resources, raising significant questions about public health consequences amid fluctuating tariff dynamics.

Additionally, the automotive sector, a vital component of both economies, faces potential turmoil under Trump’s tariff policy. As Germany and other E.U. nations export significant numbers of vehicles to the U.S., higher tariffs could lead to elevated vehicle prices for American consumers. This factor complicates consumer choices and affects dealership sales, ultimately tightening the grip of inflation throughout the economy.

EU’s Response to Trump’s Tariff Threats

In response to Trump’s recent tariff threats, European Commission President Ursula von der Leyen has underscored the E.U.’s commitment to fair trade practices while acknowledging the need for protective measures. Her administration’s proactive stance emphasizes that retaliatory tariffs will be considered should Trump move forward with his proposed plans. The E.U. has historically been a staunch advocate for international trade agreements that foster mutual economic benefit, and this situation presents a challenge to those principles.

Moreover, ongoing negotiations between the E.U. and the U.S. are critical in seeking common ground to avert escalating tensions. Trade officials are engaged in continuous dialogues, indicating a desire to resolve disputes amicably despite the ongoing trade war. The outcome of these negotiations will be pivotal in shaping future trade relations; both entities must navigate their interests carefully to ensure economic stability from either side of the Atlantic.

Impact of Tariffs on Inflation and Consumer Behavior

The introduction of President Trump’s tariffs is likely to have a substantial impact on inflation, a critical economic indicator. With existing inflationary pressures already felt in the consumer market, the upcoming surge in tariffs could exacerbate these effects. Higher prices on imported goods will inevitably trickle down to consumers, leading to increased costs for everyday essentials like groceries, electronics, and automotive parts. As consumers adjust their spending habits in response, we could see a decline in overall demand, which further complicates the economic landscape.

Economists suggest that the interplay between tariffs and inflation could extend beyond immediate price increases, potentially influencing consumer sentiment long-term. Households may opt for budget-friendly alternatives or forgo particular purchases altogether, shifting their spending in ways that could strain small businesses and disrupt supply chains. Such changes highlight the interconnected nature of trade policies and consumer behavior, emphasizing that tariffs hold consequences that ripple through the economy.

Future of U.S.-EU Trade Relations Amid Tariffs

Looking ahead, the future of U.S.-EU trade relations remains uncertain amid Trump’s tariff threats. With $605 billion worth of imports flowing from the E.U. into the U.S., any disruption could lead to severe economic repercussions on both sides. The ongoing dialogue between U.S. officials and European powers indicates a shared concern over the fallout from increased tariffs. As both parties navigate these turbulent waters, their ability to reach a consensus will be instrumental in shaping trade dynamics.

Furthermore, the United States’ trade strategy may need to evolve towards more collaborative approaches to mitigate trade tensions. Engaging in multilateral agreements rather than unilateral actions can promote stability in both economies. The challenge will lie in balancing domestic policy goals with the intricacies of international trade, where cooperation may yield better long-term results than the confrontational path currently taken.

Understanding Trump’s Tariff Strategy and Economic Impact

Trump’s tariff strategy can be seen as a multifaceted approach designed to shield American industries while addressing perceived trade imbalances. However, this approach has implications beyond immediate economic benefits. Trump’s tariff policies have created a ripple effect across markets, leading to heightened risks of inflation and uncertainty in the global economy. As trade negotiations stall and tensions persist, understanding the underpinning motivations and economic ramifications is crucial for consumers and businesses alike.

Moreover, as the trade war unfolds, analysts and economists emphasize the need for careful risk assessment regarding the broader economic landscape. Disruption caused by unilateral tariff increases calls for businesses to rethink their supply chain strategies. The potential for retaliatory tariffs may encourage companies to seek alternative markets or resources, leading to shifts in global trade patterns. Balancing protectionist aims with sustainable growth emerges as a core concern moving forward.

The Role of Analysts in Navigating Tariff Dynamics

As the landscape of international trade evolves due to rising tariffs, the role of trade analysts becomes increasingly important. They help decode the complexities of tariff impacts on domestic and global economies, providing valuable insights to stakeholders. Understanding the multifaceted effects of tariffs, such as how they influence inflationary pressures, consumer spending, and supply chain operations, enables businesses and policymakers to navigate these challenges effectively.

Furthermore, analysts contribute to identifying potential outcomes of ongoing trade disputes, assisting in breaking down repercussions for various industries, especially those heavily reliant on imports from Mexico and the E.U. Their expertise helps illuminate avenues for strategic responses to mitigate risks associated with fluctuating tariff policies. In a time of uncertainty, informed analysis plays a crucial role in shaping effective economic decisions.

Frequently Asked Questions

What are the Trump tariffs on EU and Mexico?

The Trump tariffs on the EU and Mexico entail a proposed blanket rate of 30% on all goods exported to the U.S., set to begin on August 1, unless either party retaliates. This move is part of the broader context of the Trump trade war, aimed at addressing trade imbalances and border security concerns.

How will the Trump tariffs on EU and Mexico affect U.S. consumers?

The Trump tariffs on EU and Mexico may lead to increased prices for various imported goods, including pharmaceuticals, automobiles, and fresh produce. This could contribute to inflationary pressures in the U.S. economy, particularly impacting consumer goods reliant on imports from these regions.

What impact do Trump tariffs on imports have on inflation?

Analysts are warning that Trump tariffs on imports could exacerbate inflation, already on a precarious trajectory. The introduction of higher tariffs may increase costs for businesses, which could then pass these costs onto consumers, potentially extending the timeline for increased inflation.

Are there retaliatory tariffs expected from the EU and Mexico in response to Trump’s tariffs?

Yes, both the European Union and Mexico have signaled that they may impose retaliatory tariffs in response to Trump’s new tax on imports. European Commission President Ursula von der Leyen has stated that necessary steps will be taken to safeguard EU interests, which could include implementing their own tariffs.

How significant is trade between the U.S. and Mexico before the Trump tariffs?

Before the Trump tariffs, the trade relationship between the U.S. and Mexico was highly significant, with Mexico accounting for over $505 billion in goods imported by the U.S. in 2024. It is a crucial partner, especially for fresh produce and vegetables, underscoring the potential consequences of increased tariffs on consumer prices.

What are the potential consequences of the Trump trade war with the EU?

The Trump trade war with the EU could lead to strained economic relations, increased costs for American consumers, and higher prices on imports, especially in sectors like pharmaceuticals and automotive. Ongoing negotiations aim to avoid these trade tensions, but the threat of tariffs looms large.

How do Trump’s tariffs on the EU compare to those on Mexico?

Trump’s tariffs on the EU are set at 30%, which is higher than the previous 20% indicated for earlier tariffs, while Mexico’s tariffs are also proposed at the same rate. Both countries, however, may face different economic repercussions based on their unique trade dynamics with the U.S.

What goods are most affected by the Trump tariffs on imports from the EU?

Goods most impacted by Trump tariffs on imports from the EU include pharmaceuticals, automobiles, aircraft, and heavy machinery. The pharmaceutical sector, particularly, is under scrutiny, with potential tariffs reaching as high as 200% in the future.

Will the Trump tariffs on EU and Mexico be implemented as originally planned?

While the Trump administration has announced plans for significant tariff increases, the actual implementation may depend on ongoing negotiations and potential retaliation from the EU and Mexico. The situation remains fluid, and developments could alter the timeline or structure of these tariffs.

How might Trump’s tariffs affect agricultural imports from Mexico?

Trump’s tariffs may affect agricultural imports from Mexico significantly, given that Mexico supplies 69% of U.S. vegetable imports and 51% of fresh fruit imports. Price increases for these fresh products could occur rapidly due to their short shelf life and reliance on imports.

| Key Point | Details |

|---|---|

| Tariff Announcement | Trump announced a 30% tariff on all goods from the EU and Mexico, starting August 1. |

| Retaliatory Threats | Trump warned of increased tariffs if either region retaliates. |

| Focus on Border Security | Trump emphasized Mexico’s role in border security and combating drug cartels. |

| Trade War Escalation | Following letters announcing tariffs, Trump proposed further tariffs, including a 50% duty on copper. |

| EU’s Response | EU leaders expressed commitment to fair trade practices and consideration of retaliatory tariffs. |

| Mexico’s Trade Significance | Mexico accounted for over $505 billion in goods imported by the U.S. in 2024. |

| Impact on Inflation | Analysts warn that new tariffs could exacerbate inflation risks. |

| Ongoing Negotiations | The EU is engaged in continuous negotiations to prevent the impact of tariffs. |

Summary

Trump tariffs on EU and Mexico have become a critical issue in international trade, as President Trump announced significant increases to the tariffs imposed on these major trading partners. These tariffs are set to create considerable economic consequences and potential retaliation, drawing attention to the fragility of U.S. trade relationships and the implications for inflation rates in the future.